Gift card reselling is becoming a more popular activity for a couple of reasons:

- Profit – It’s frequently possible to buy first-hand gift cards at a large enough discount that you can resell them and make a few dollars.

- Credit Card Rewards – Buying a lot of gift cards brings with it the opportunity to earn a lot of credit card rewards. In many cases, discounted gift cards are sold at retailers (e.g. grocery stores, office supply stores, etc.) where you can earn a category bonus with some credit cards, increasing the rewards earned even further.

While gift card reselling has some great benefits, it also has its risks. If you’ve recently started reselling gift cards or are thinking about exploring the opportunity, here are some tips to help you start successfully. There’s also a link to a free downloadable gift card tracking spreadsheet you can use.

1) Gift Card Sourcing

If you want to resell gift cards, you need to know how to buy them at a discount. It’s good to have several different avenues for sourcing discounted gift cards, so check out our list of 25+ ways to save money on gift cards. Amex Offers in particular provide some great opportunities.

2) Pricing

The first rule of gift card reselling is similar to investing in the stock market – ‘Buy Low, Sell High’. That’s an ideal scenario, but sometimes you’ll have to settle for ‘Buy Low, Sell High(er)’ or ‘Buy Low, Sell Break Even’. Those latter two options don’t have quite the same ring to them, but they’re more realistic.

Why would you want to resell gift cards at the same price for which you bought them? The main reason will be credit card rewards. You might break even on the cards, but if you make 2-5% back on the credit card you bought them with then you still come out ahead. If you bought them from a grocery store, perhaps you also earned fuel points. Or maybe the store has a loyalty scheme that offers rewards even on gift card purchases (e.g. Best Buy).

It’s obviously better to receive these side benefits while also making a profit, but having a deal be break even needn’t be a deal-killer.

3) Don’t Ramp Up Activity Too Quickly

Slow and steady wins the race. There are all kinds of potential risks involved with gift card reselling, with those risks being higher when starting out while you learn all its different quirks.

It’s therefore best to not commit thousands of dollars as soon as you start out in case you have problems liquidating gift cards or a potential deal doesn’t work as expected.

4) Read Terms Carefully

Read the terms of gift card deals carefully as it’s easy overlook wording that explains an offer.

For example, grocery stores sometimes have digital coupons offering discounted gift cards, such as ‘Buy two Macy’s gift cards and save $10’. The title of the offer might seem self-explanatory, but clicking on the terms might show something like ‘Must spend minimum of $50’ or ‘$15 gift cards excluded’. If you bought two $15 cards, you wouldn’t get the $10 discount. You’d then be left with $30 in Macy’s gift cards you’d either have to use yourself or resell at a loss.

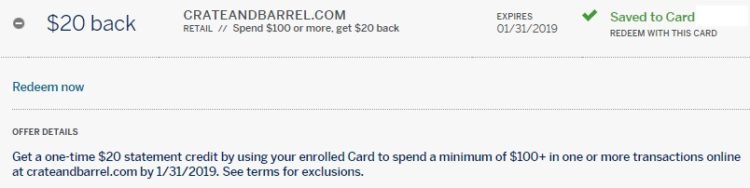

Amex Offers are another good example. Some offers are for in-store only, some are for online only, while others can be used both in-store and online. One time I headed to a Crate & Barrel store to buy a gift card so I could take advantage of an offer giving $20 back when spending $100. I thankfully checked the terms before paying though as the offer excluded in-store purchases.

5) Know What Type Of Cards You’re Getting

This is particularly important when buying gift cards from retailers online. Will you be getting an eGift card by email or a physical gift card in the mail? For some brands, gift card resellers will only buy physical gift cards from you. If you bought eGift cards for one of those brands, you could have trouble offloading it.

6) Know What Value Gift Cards You’re Getting

Some gift card promotions run along the lines of ‘Buy $50 and get $10 free’. Does this mean you’re getting a $60 gift card or a $50 card and a $10 card?

In many cases this won’t matter, but some gift card resellers – particularly bulk buyers – might not buy low denomination cards ($5-10).

7) Beware Of Promo/Bonus Cards

This ties in with both the 4th and 5th points above. Some gift card deals offer a ‘promo’ or ‘bonus’ card when buying a gift card. This often happens with Adidas gift card deals, as well as promotions that restaurants sometimes offer.

In the example below, Ruby Tuesday offered a $15 bonus card for every $50 in gift cards you bought. Unfortunately that didn’t mean you’d have $65 in gift cards you could resell. That’s because the $15 card was a bonus card (sometimes called a promo card) that was only valid between certain dates – in this case from January 2 to March 5, 2019.

They can therefore be great for personal use if you can use them between the allotted dates. Due to their expiry dates though, no gift card reselling companies will buy them from you.

8) Check The URL When Buying Gift Cards Online

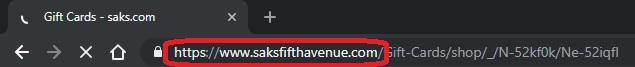

Several retailers use third parties to process their eGift cards. Let’s say you want to buy a Saks gift card to take advantage of the American Express Platinum benefit. If you ordered a physical gift card, you’d see the URL in the address bar would remain at saksfifthavenue.com.

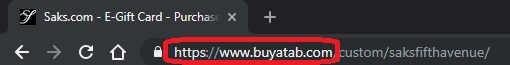

However, if you selected an eGift card then you’d see a different URL in the address bar. That’s because Saks uses a company called Buyatab to process its eGift card orders.

The twice-annual $50 Saks credit wouldn’t be triggered by an eGift purchase from Buyatab, but would with a physical gift card purchase from Saks.

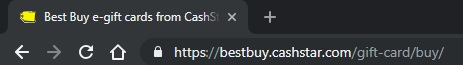

You’ll also often find eGift cards being processed by CashStar.

Why does this matter? Because some deals – particularly Amex Offers and Chase Offers – won’t be triggered by purchases from CashStar et al. For example, there are frequently Best Buy Amex Offers for ‘Spend $300 and get $30 back’ or similar amounts that give a 10% statement credit. If you bought an eGift card, you wouldn’t get the $30 back as the transaction would show as CashStar rather than Best Buy.

9) Use Cashback/Airline Portals

Whenever you buy anything online, you should click through from a cashback or airline shopping portal. Each portal offers different rates, so compare rates on Cashback Monitor before making a purchase.

Most portals exclude gift card purchases, but that’s no always enforced and so you might earn cashback/bonus miles when buying gift cards online.

Some shopping portals also offer cashback in-store at certain retailers. Ebates is one of the most well-known portals (you might’ve seen their ads on TV) and they offer an in-store program. You have to add your credit and debit cards to the program and link the cards to specific offers. Again, gift card purchases are usually excluded but have been known to track at times.

If you’re new to Ebates, here’s my referral link. At the time of writing this guide, if you sign up and spend at least $25 having clicked through from their portal, you’ll earn a $10 bonus as will I.

10) Stay Organized & Record Everything

It’s vitally important to keep good records when reselling gift cards. If there are ever any problems, you’ll want to be able to check your records.

Here’s some of the information you’ll want to keep track of:

- Date you bought the gift card

- Gift card brand

- Where you bought the gift card from

- Value of the gift card

- How much you paid

- Which credit card you used

- The gift card number and PIN

- How much you resold it for

- Who you resold it too

- When you received payment for the card

To help get you started, I’ve created a free gift card reselling spreadsheet template you can use. That post has a link to the template itself which you can download, as well as a guide to all the columns in it.

11) Keep Gift Cards – Both Physical And Digital

If you ever have problems with a gift card after it has been sold, you’ll want access to it. For eGift cards that are emailed to you, it could be worth setting up a folder in your email that they’re stored in. (n.b. Set up two-factor authorization on your email account to reduce the likelihood someone could hack in to your email account and access the gift cards).

For physical gift cards, you’ll want to keep them stored somewhere safe unless you’ve had to mail them to the company that bought the cards.

12) Potentially Problematic Brands

Most retailers offer gift cards where you can check the balance either online or over the phone. There are a few brands though were you can’t check the balance. With these cards, the only way to verify their value is to apply it to your account, but that means they can’t then be resold.

At the time of writing this, the main gift card brands this affects are:

- Amazon

- Groupon

- Uber

- iTunes

- Google Play

- StubHub

- Zappos

You might therefore find that some gift card resellers won’t buy these brands from you. Others might buy them, but they’ll require physical gift cards be mailed to them or that you provide them with links to eGift cards.

12) Sudden Rate Changes

The rates you’ll receive when selling gift cards will tend to be fairly steady for the most part. There will be occasions though when the gift card reselling market is flooded with a certain brand, usually when there’s been a promotion.

When that happens, the resale rate for that brand might drop significantly. That could turn a profitable deal into a loss-making one. There are a few ways to deal with this risk:

- Resell Quickly – Resell gift cards as soon as you get them to try to beat rate changes. If you get in on a deal early enough, this might be possible. For new gift card resellers though, there’s a good chance more experienced resellers will get there first.

- Wait It Out – When the market becomes flooded, it might take weeks – or months – for the rate to get return to where it was previously. If you have the cashflow to float the money, this option can be worth considering.

- Take A Loss – If your cashflow isn’t great and you need to get paid back ASAP, you might have to sell at the lower rate. You might lose a few dollars on each gift card, but that’ll likely be better than the interest that’d be charged on your credit card if it’s not paid off immediately.

A quick note regarding the third point above. If it’s likely that you’d struggle to pay your bills if you weren’t able to sell gift cards quickly, gift card reselling might not be for you. Some gift card resellers will pay you quickly, but there’s always risk involved when reselling gift cards. If a delayed payment would mean you’d risk defaulting on your mortgage or you couldn’t make your monthly rent, be sensible and don’t put your housing at risk.

13) Register For Card-Linked Programs

There are numerous card-linked programs out there that reward you for everyday (and not-so-everyday) purchases. These are apps where you link your credit and debit cards and you earn cashback when shopping in-store and, occasionally, online. It works in a similar way to in-store offers through cashback and airline portals, but it might be possible to stack the offers to earn cashback with both.

My favorite card-linked app is Dosh. At the time of writing, you can get cashback when shopping at Sam’s Club, Pizza Hut, Chevron, Exxon, Cost Plus World Market, Walmart, Sephora, Forever 21, BarkBox and many more retailers and restaurants.

There was recently a Chase Offer giving 10% back at Sephora, while Dosh was also offering 8% back. I was therefore able to buy a $100 Sephora gift card in-store for $82. Taking advantage of opportunities like this will either increase your profit or make previously unprofitable gift card deals more worthwhile.

14) Register For Retailer Reward Programs

I touched on this earlier, but thought it was worth covering separately. Some retailers offer their own reward programs and, in some very rare cases, you can earn rewards when buying gift cards.

The most notable of these is Best Buy. Not only can you earn rewards when purchasing Best Buy gift cards, but also when buying any third-party gift cards in-store and online. Many Best Buy stores now stock Amazon gift cards, so that can be a great opportunity when there’s an Amex Offer.

I mentioned earlier about a Best Buy Amex Offer giving a $30 statement credit when spending $300+ at Best Buy. It’s not always easy to buy Amazon gift cards at a discount, so getting 10% off and earning $3-$7.50 in Best Buy Rewards along with points/miles on your credit card is a great deal.

15) Gift Card Buyers

When starting out on your gift card reselling journey, the easiest places to resell your gift cards will likely be to companies like Cardpool and CardCash. The benefit with selling to them is that with most brands you can sell them your cards immediately and get paid quickly by check or ACH.

An alternative is to list your cards on marketplaces like Raise (my referral link). You set the rates at which you wish to sell and Raise (or whichever other marketplace) takes a percentage of that.

One benefit of selling on Raise is that you might be able to sell at a higher rate than you can directly to companies like Cardpool and CardCash. A downside is that in many cases you’re selling to individual buyers. If there’s no buyer for the gift card you’re selling at the price you want to sell it for, it could sit there for weeks or months, potentially affecting your cashflow.

I’ve personally never sold on Raise simply because I want to make my life easier. I’d much rather sell my cards directly to a gift card reseller and get paid quickly, than have them sitting around on an exchange gathering digital dust. I’m probably leaving money on the table by not getting higher rates, but I’m OK with that.

I’ve sold to both Cardpool and CardCash in the past and had good experiences overall. Cardpool has since been bought and people have reported delays in receiving payments, so be aware of those issues.

16) Apply To Be A Bulk Seller

Once you’ve been selling gift cards for several months and are more accustomed with the process, it might be worth applying to become a bulk seller as they tend to get better rates. This in turn opens up more opportunities and makes existing deals even more profitable.

It can also come with other perks, such as free FedEx or UPS shipping labels when having to mail them physical gift cards. The cards reach the buyer more quickly than via USPS, so you get paid sooner.

My understanding is that Raise offers a similar program where their fees are much lower for bulk sellers.

17) Maximize Your Float Time

No matter how you buy your gift cards, you’ll have to float the cost. This’ll sometimes just be a few days; other times it’ll be several weeks or months. It can therefore be helpful to maximize your float time when possible.

A good example is when you buy discounted gift cards using Amex Offers. Amex Offers tend to be valid for at least a month, so that gives you an opportunity to maximize your float time. Let’s say you load an Amex Offer to your card on the 1st of the month but your statement doesn’t close until the 15th of the month. Wait until your statement has closed before buying a gift card using the offer. You’ll have a full month until that transaction is on your next statement, then you’ll have a few weeks to pay that card. This can give you ~7 weeks to receive payment if you resell the gift card immediately, assisting with cashflow.

18) Have A Backup Plan

Sometimes things go awry. Gift card reselling companies go belly up. A reselling company stops buying certain brands or drastically reduces the rate they’ll pay. Cards listed on Raise don’t sell.

It’s therefore good to have a backup plan. If the normal place where you sell cards isn’t buying them got whatever reason, are there any alternatives? If not, it might be worth giving that particular gift card brand a miss unless you’re OK with taking a temporary – or possibly permanent – hit.

19) Don’t Risk More Than You Can Afford

Like I mentioned above, sometimes things go awry, like gift card reselling companies going belly up. That happened in 2018 when The Plastic Merchant went bankrupt. Checks they’d issued bounced, then there was radio silence, then their selling platform disappeared.

I was affected by this and took a loss of close to $1,000, but I was one of the lucky ones. One person in a Facebook group I’m part of had submitted cards worth ~$25,000 and their check bounced. As far as I know, they were never reimbursed. Sickening.

I’ve already mentioned that gift card reselling can be risky, but seriously – don’t risk more than you can afford. I’d had a good experience with The Plastic Merchant up to that point, but that counted for nothing. Thankfully we had savings and so although it was painful, the loss didn’t impact upon our lifestyle.

20) Verify Payments

Other than the (large) issue with The Plastic Merchant, I’ve had very few issues regarding payments. Having said that, a couple of times CardCash sent me less than they should have.

Their reasoning was that supposedly a couple of gift cards I’d previously sold them were no longer valid. Thankfully I could view the details of those gift cards in my account and there wasn’t a problem with them, so ABC quickly reimbursed me for them. I don’t think they were scamming me, but definitely make sure payments match what you should be sent. That just one example of how a good gift card tracking spreadsheet can help you.

21) Don’t Buy Second-Hand Gift Cards And Resell Them

It’s possible to buy discounted gift cards from eBay, Raise, etc. that are second-hand (i.e. someone else bought them and is reselling them like you want to do).

Be aware that it’s against the terms and conditions of many gift card resellers to sell them cards that have been owned by other people. That’s because this increases the risk as more people have access to the card number and PIN, thereby increasing the likelihood that the cards could be drained by someone.

Next Step

Now that you have a better idea for how to get started with gift card reselling, check out our list of 6 easy ways to stack gift card purchases to save even more money (AKA making more money when reselling!)