Update 10/4/24: Since I published this post back on August 19, Pepper Rewards has continued going strong. Well, going strong in terms of the deals they’ve offered – not necessarily on the ‘ongoing viability’ side of things. Over the past 1.5 months, I’ve gotten continually more concerned about how things are being structured. For example:

1) It feels like there are even more deals each day which are even more generous than they were by mid-August. We’ll frequently see at least half a dozen deals per day, sometimes more than that, with the rates being much higher than those you’d normally see on an unlimited basis elsewhere.

2) Purchase levels were previously limited to $5,500 per day (well, rolling 23 hours I think), but yesterday they randomly increased limits to $9,750 per day for many power users. As far as I’m aware, the users hadn’t requested an increase in buying capacity; it just seems like Pepper saw that these people were spending a lot and wanted them to have the ability to purchase much more each day. Ordinarily, that would be a fantastic thing, but when those users’ money is on the line, that’s not necessarily such a great motivation for Pepper Rewards to have.

3) Up until a couple of weeks ago, deals that offered bonus points had those bonus points awarded 15-21 days after your purchase depending on which day of the week that you bought the cards. That’s now been changed to a rolling 18 day period from your date of purchase. While that’s effectively splitting the difference between the 15-21 days and so might be innocuous enough, a change like that has me wondering if there are cashflow issues.

4) Due to the way that Pepper had been structuring deals up until a couple of weeks ago, they were having to award large chunks of bonus points on Monday mornings when those became due. I’d originally written below about how it seemed like bonus points were being manually calculated and credited rather than it being an automated process and that still seems to be the case. I’ve also seen numerous people reporting that some points they were due weren’t credited correctly, while other times those bonus points weren’t credited until soon before midnight ET rather than by 5pm ET which is what used to be the case.

5) Pepper Rewards has decreased the resale rate on many high value gift card brands in recent months. That means the value you get when redeeming the points you earn from purchases has decreased if you were reselling those cards.

Anyway, all this to say that I continue to be bearish about the ongoing prospects for Pepper Rewards, so please once again do your own risk assessment. For example, let’s say your purchase limit was just increased to $9,750 per day; that’s $175,500 over an 18 day period which we’ll round down to $150,000 seeing as that’s the 4x earning limit on an Amex Business Gold card. Let’s also say that you’re buying deals which are set to award you an average of 15% back – 5% now and 10% in 18 days. That means that over the 18 day period you’ll have earned $7,500 back instantly (which can only be redeemed for other gift cards in the app), while you’re waiting on $15,000. Can you afford to lose that $15,000? If not, you’re potentially putting your entire financial life in jeopardy.

On a similar note, it’s well worth reading Miles Earn And Burn’s post about Pepper that he published today too.

If you’re financially-minded, you might also be interested in Moocho’s SEC filing from December 2023 (Moocho is the company that runs Pepper Rewards). A few eye-catching sections include pages 12-15 of that document, such as:

- In 2021 they had revenue of $1,709,972 and expenses of $5,373,246, while in 2022 they had revenue of $2,489,189 and expenses of $7,813,852.

- There’s a long list of creditors, with ~$2 million of that debt having been secured at rates of 15%-20%. I’m not sure if that’s been paid off, extended or renegotiated.

Page 34 of that document meanwhile notes that if they were unable to raise funding, there were issues with their ability to operate as an ongoing concern:

The accompanying financial statements have been prepared on a going concern basis, which contemplates realization of assets and the satisfaction of liabilities in the normal course of business. The company has a net operating loss of $5,960,854, an operating cash flow loss of $1,019,815 and liquid assets in cash of $81,066, which is less than a year worth of cash reserves as of December 31, 2022. These factors normally raise substantial doubt about the Company’s ability to continue as an ongoing concern.

So once again, please do your due diligence and a proper assessment of your risk tolerance.

Here’s the original post.

Pepper Rewards burst on to the gift card scene in early 2024 and has since run many superb gift card deals. It started off with earning 10% back on all gift cards in your first 30 days, then they started offering some good discounts and/or increased earning rates on high value gift card brands.

In addition to that, purchases code for 4x Membership Rewards points on the Amex Business Gold card if that’s one of your top two spending categories that billing period, as well as 3% on some Bank of America cards. This is enabling people to rack up a very large amount of bonused spend which is made even better if you’re working on the welcome offer for a new Amex Business Gold card and/or authorized user bonus offers.

It feels like deals have picked up at a frenetic pace in recent weeks, with day after day seeing incredibly generous earning rates on high value brands like Amazon, Sam’s Club, Netflix and many more. Despite these rewarding opportunities, I’ve personally been shying away from taking advantage of them. I’ve been growing increasingly concerned about how things could turn out, so I wanted to post a warning to encourage people to once again evaluate their risk tolerance.

Issues, Concerns & Frustrations

There have been quite a few issues, quirks, etc. in recent weeks and months which have caused frustration for myself and other users:

Welcome bonuses

Up until recently, Pepper offered double cashback for new members. There have been numerous reports recently that people’s doubled bonuses haven’t posted on time. Pepper has apparently claimed that this is due to them determining that people had self-referred and set up duplicate accounts, but my understanding is that they hadn’t communicated this to affected users, with some affected customers being adamant that they’d not self-referred.

App issues

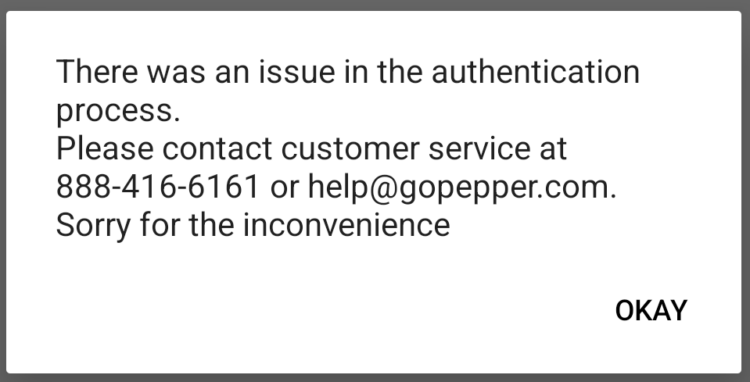

There have been increasing instances of people being locked out of the app. When trying to regain access, they’re having to change their password but this is resulting in some kind of loop where they have to keep resetting the password and not gaining access to their account. Both my wife and I had been unaffected by this up until now, but when opening the app this morning on my phone I encountered this exact problem.

Earning/Redeeming Rates & Changes

Pepper Rewards has always had a wacky way of rewarding you for gift card purchases. The app initially awarded points where 1 point earned was worth $0.25. That was confusing enough – why not have $0.25 be the same as 25 points?

Then in May 2024 they made a change to the earning structure in terms of how many points you’d earn. The value you’d earn in dollars and cents remained unchanged; it was how points mapped across that was different. At that point you earned 100 points for every dollar spent, with 20 points being worth $0.01. That resulted in ludicrous and nonsensical points balances with regards to actual monetary value. For example, when the changeover happened I ended up with 781,500 points. If you’re wondering how much those points were worth, it was $390.75. To calculate monetary value, you had to divide the points/coins by 2,000 which is, quite frankly, a weird and bizarre setup.

Not content with those changes, two months later Pepper Rewards made another significant change. This time they went from offering 5% back on all gift cards to offering 1% back as standard but with boosted rates on pretty much all brands to one extent or another. Rather than earning 100 points per dollar spent, you now earn 20 points for each percent of any given gift card’s rate. If it’s at 4x, that equates to 4% back and so you’d earn 80 points per dollar, 10x = 10% or 200 points per dollar, etc.

Charged For Cards That Don’t Generate

Several people have reported recently that when buying multiple gift cards in a single transaction, one or two of the cards got generated, but others had blank card numbers and PINs but they were charged for those cards. To Pepper’s credit, my understanding is that after the customers have reached out to customer service they’ve received a prompt refund.

App Doesn’t Track What You’re Owed

Perhaps the biggest frustration I – and many readers – have had is that whenever Pepper Rewards offers boosted rates, they give zero indication as to how many points you’ll eventually be earning, nor do they give you any kind of way of tracking how many points you’re still due for past purchases.

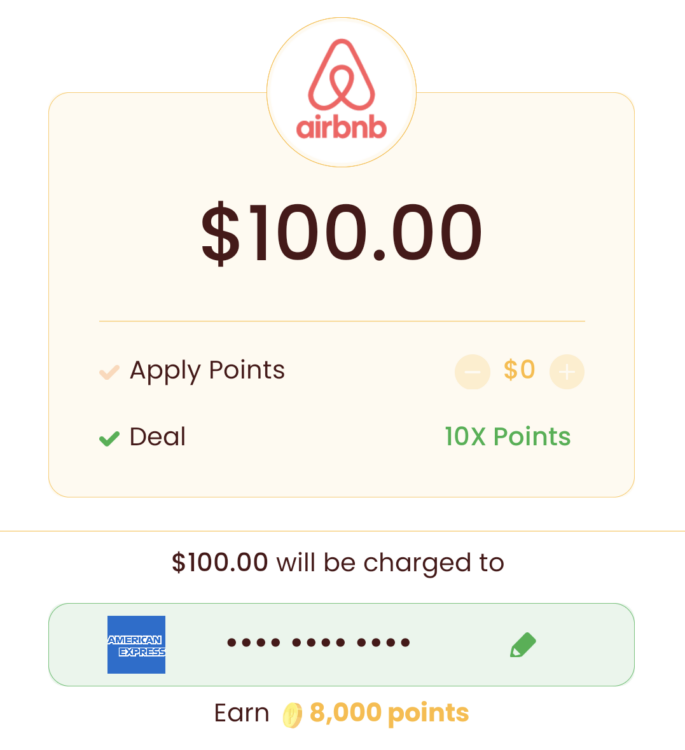

For example, one of the offers at the time of publishing this post is earning 10x on Airbnb gift cards. As explained earlier, that equates to 10% back. However, only some of those points are awarded now, with the balance of the points being awarded in a few weeks. With purchases earning 20 points per dollar per percentage earning rate, that would mean that a $100 gift card purchase should earn 20,000 points. However, the app instead states you’ll earn 8,000 points.

For customers unfamiliar with the app, that’s extremely confusing. What’s happening in this scenario is that you’re earning 4% back now (which is the 8,000 points), with the remaining 12,000 points being awarded in a few weeks. The thing is, nowhere does Pepper Rewards tell you that you’ll later be earning an additional 12,000 points, nor do they list that after your purchase, nor do they provide any way of tracking when you’ll earn those points. You therefore either need to keep meticulous records of what you’re owed and verify that they’ve been credited, or hope and trust that Pepper Rewards won’t balls it up when calculating how many bonus points you should be credited with.

Speaking of which…

Bonus Points Are Manually Credited (Resulting In Errors)

Based on reports I’ve seen elsewhere, Pepper Rewards doesn’t automate the number of bonus points that are awarded. Instead, they apparently have staff members manually crediting people’s accounts with the requisite number of points. What could go wrong?!

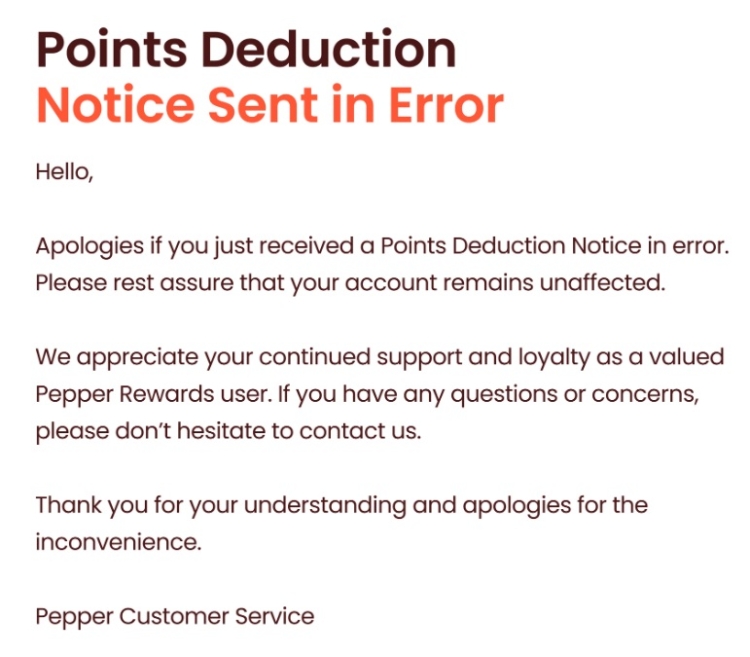

Well, there were recently cases where people weren’t awarded the correct number of points and so they had to repeatedly follow up with Pepper to get the correct number of points. Other people were awarded too many points; they subsequently redeemed those points, Pepper clawed the erroneously-issued points back and so those affected customers now have a negative points balance.

When some of these recent issues occurred, Pepper sent emails out letting people know they’d had points clawed back. Only they sent that email to many customers who weren’t actually affected, causing even more confusion until they sent out a follow up email stating that their error about an error was an error.

Ongoing Viability vs Ponzi Concerns

Perhaps my biggest concern though relates to the app’s ongoing viability. The gift card deals that Pepper Rewards offers are so generous that they must be making a sizeable loss on many of them. Add in the cost of staff salaries, credit card processing costs, etc. and they’re presumably burning through money very quickly.

Moocho – the company that owns Pepper Rewards – raised $23,048,000 at the end of 2023. When companies have money to burn in attracting new users, that can make for lucrative opportunities like we’re seeing here. The reason I’m concerned though is due to the way the app’s promotions have been set up in recent weeks/months.

Other than the doubled new user bonus earlier this year (which is no longer available), Pepper’s older promotions either gave an instant discount or boosted rates where the bonus points were awarded immediately. That meant there was no risk for users if they were cashing out their points promptly once they were earned.

The problem is that Pepper has changed that setup recently. Now when they offer boosted rates, you earn a small amount now and a much larger chunk later. When they started running promotions this way, the bonus points would be awarded two weeks later. With the new promotions they launched the day I’m posting this warning though, you now have to wait three weeks for those bonus points to be awarded. That’s therefore loading a lot of risk on to customers in the event that the app goes kaput.

What’s giving me even more pause is that the app is now set up in a way that’s reminiscent of a Ponzi scheme and it’s giving me Hard Body Fitness Club vibes (IYKYK). Just to be clear, I’m not saying that Pepper Rewards is a Ponzi scheme; I think they’re just setting up promotions this way to manage cashflow. However, the way they’re approaching this is raising red flags for me about what would happen in the event that they do run out of money.

They onboarded a lot of new users at the start of the year, then changed the earning structure not once but twice. They’ve increased the rate of money-losing deals (for them) at a fast pace, day after day, week after week. They don’t provide any way of knowing how many points they owe you. They started delaying bonus payouts until two weeks after people had made their purchases and now they’ve increased that timeframe to three weeks. Depending on how hard you’re hitting these deals, that’s potentially a lot of money tied up in points to be awarded in the future.

For example, let’s say you’re a gift card reseller who’s spending $50,000 per month in the app (if that sounds insane to you, there are people who are probably doing far greater numbers than that). All the boosted deals are different, but let’s assume on average you’re earning 5% back now and 10% back in the future. That means you’ve potentially got ~$5,000 in pending points. If Pepper Rewards runs out of money, that’s money you should assume you won’t be getting back. In that scenario you can’t submit a chargeback to your credit card company because you did actually receive the gift cards you purchased; you just weren’t rewarded for them as you’d anticipated. Update: Apparently you would be able to do a chargeback due to you not receiving goods/services as advertised, although it’ll probably be a bit of a headache. h/t Shay.

For some people losing $5,000 would be painful, but it’s a loss that could be absorbed. For other people, it could mean they’re unable to make their rent or mortgage payment, putting them in severe financial difficulties.

I haven’t seen any signs that Pepper Rewards is going bust and, like I said, I don’t think that they’re deliberately setting themselves up as a Ponzi scheme in order to scam people. I just want to make sure that if you’re buying gift cards at a large scale that you take time to evaluate your risk tolerance and your personal financial situation in the event that you aren’t able to redeem the points that you’re owed.

Ultimately, we’re all adults and we can make our own choices based on our own risk tolerance. I’ll therefore still be posting Pepper Rewards deals here on GC Galore because they’re often so good. I’ll also still be using the app for gift card purchases for personal use. However, for as long as Pepper Rewards runs deals where you have to wait three weeks to receive a significant chunk of the points – and with them providing zero way to track how many points you’re owed, manually crediting the points and even then sometimes making errors with that – I’m personally avoiding it for gift card reselling purposes at a large scale.

and there we go. thank you for this. this had to be said.

Logical conclusion 👍

Anyone buying gc with the anticipation of getting coins back or holding onto coins at this point is basically risking it for the biscuit. There is NO way they make good on the problems posted above and the numerous dp of missing points. You’ve been warned.

It’s a ponzi scheme. They have 2 support people in their support staff, handling everything from refund to points to just answer email. I have a refund that they promised to issue for 3 months now. I expect a big rug pull in the coming months.

did this age well?

yeah

after the new user promotion, I deleted the app for many of these reasons

Personally, I never bought into Pepper even though it’s been heavily promoted. It’s puts heavy onus on the purchaser to have faith in it’s rewards program but their platform and transparency fails to inspire confidence.

I haven’t been able to access my account for a month. 6 calls, 6 emails. Crickets. I’ve got pepper points locked up and can’t access them. I did a chargeback once (refused to give me the points owed) and when the chargeback went through, the next day my account access was blocked. Not a coincidence. This is the plastic merchant all over again, but much higher stakes.

I’m pretty sure they didn’t like the chargeback. And also I’m pretty sure that doing so violates their terms and therefore they prob shut your account accordingly. But it’s sucks that you had no other choice other to issue the chargeback bc they weren’t holding up their end of the bargain. But as mentioned in the article not posting rewards isn’t something that should be chargebackable as you received the product purchased.

Did your chargeback succeed?

Yes, it did succeed. Pepper violated my terms and conditions.

Did you ever gain access to your account again?

I never got into Pepper because of a lot of the issues listed that you wrote about. It always seemed like a VERY SUSPECT app to me. Thank you for putting all of your thoughts on this subject out there. Keep the content coming!

Stephen, after an article like this, you NEED tell your buddies at Aligned Incentives to stop posting “deals” for Pepper. They are putting people in the line of fire!

Like I said at the start of the final paragraph:

Ultimately, we’re all adults and we can make our own choices based on our own risk tolerance.

I’ll still be posting about the deals here on the site as they’re still notable. I don’t see any reason why Aligned Incentives – or any other buying group – should stop posting deals if people want to continue buying gift cards from Pepper when there are these promos.

I actually think the consolidators are behaving irresponsibly. They ultimately won’t hold the bag when this all explodes. A good consolidator shouldn’t buy these bombs anymore.

Aligned Incentives emails are scams anyways. They send out rates and then 2 minutes later they lower them 2%.

You’d be surprised how many people make reservations immediately after deals are posted. There is also a dedicated telegram channel for new deal alerts, which is probably faster than checking for emails.

They’re not scams. They have a limited capacity of gift cards at a certain rate. If there was an unlimited amount of supply, the resale rates drop accordingly. When you make a reservation on their website, you can always see what rate you’re reserving at. If you reserve that rate, it’s locked in – they don’t lower the rate retroactively. The rate might drop between the time they set up the deal and when you actually make a reservation, but there’s no bait and switch there.

You’re welcome to go to the notifications tab of your profile and switch off notifications for the Pepper deal source. I think we’re pretty open about the risks but as Stephen says, our members are adults who can decide for themselves what risks they want to take. We host an entire Pepper chat where people do nothing but hate on Pepper and stress out all day long. If you’ve got any ideas that do not deny our members their own agency, let me know.

As a bulk reseller, you take no risk offering these deals to members. Members take all the risk. From your perspective, if a member(s) gets screwed by Pepper, you’ll just find more fresh bodies to take their place? At what point does the integrity of a reseller come into question? As with the plastic merchant, if and when things go south with Pepper, bulk resellers will not make you whole. And an attorney general will not save you. And good luck finding a lawyer to take on a class action lawsuit. The plastic merchant went bankrupt and his lawyer in court said HE was defrauded by people that he bought cards from. Sure, everything has risk, but clearly some things are more risky.

Again though, people are willingly choosing to take on risk. There’s clearly a demand for these deals, so why shouldn’t Aligned Incentives – and other bulk buyers – provide an opportunity for people to buy the gift cards? As Logan mentioned above, AI has a dedicated Pepper Rewards channel with endless discussion about the deals and risks. If people are going into it with eyes open, I don’t think AI should be blamed if something bad eventually happens. And it could well be that nothing bad does end up happening with Pepper Rewards.

Sounds like you’re a consolidator though I don’t know which group is yours. I think you need to consider whether you’ve properly de-risked your holdings. If there’s poison in the stream all the fish drink from it.

https://en.wikipedia.org/wiki/Financial_contagion

Yes, I think the consolidators are acting irresponsibly.

I really appreciate this post as there’s been a lot of enthusiasm about Pepper, both the app and the Stephen.

I want to add to the updated comment on chargebacks in the hypothetical case that Pepper fails without making you whole. I think a better analog of Pepper is not HBFC but Cyberrebate. They sold merchandise, and offered a rebate, often at 100%. Pepper also offers a rebate in the form of any gift card you choose, valued by the delayed coins you are rebated. Cyberrebate eventually failed and denied outstanding rebates, sometimes making up bogus reasons about not following the rebate procedure. People filed chargebacks and many won or lost depending on the argument and record keeping. You can argue the incentive is part of your purchase and not granting it is unjust enrichment. Depending on the state, there may also be consumer law to reference. Also you will have a much harder time if you paid with a business card, due to the difference in consumer law for personal cards. I am not a lawyer. Incidentally, it was harder to win CR chargebacks with Amex than other cards, because Amex is their own merchant bank. For Visa, MC, Discover, the reserve funds held for CR were a separate entity.

I’m gonna date myself, but I also remember Cyberrebates! IIRC, visa/mc mostly refunded people who disputed the charges. Amex and Discover did not, since they were their own merchant banks. If you filed a small claims suit against Amex, you would get an offer to settle before the court date (for the full dispute amount), while Discover would go to court, and it was 50/50 whether or not you’d win the small claims case. I disputed maybe $1K on Capital One visa, and Cyberrebates did not file a response within the deadline so I won that dispute. I had unfortunately charged more on Discover. I did not file a small claims lawsuit given that it would be a lot more work without a guaranteed result. I boycotted Discover for a long time after that (eg still kept my card, but charged $1.99/month on it). However, I did get ~$2K x 2 from the Discover apple pay promo ~10 yrs ago, and Discover has some great account options currently, so it was just as well that I kept my accounts open.

Anyway, in terms of Pepper, the rates being offered by the bulk gc purchasers are almost always at a loss, so I have not purchased that much in the recent months. So, I didn’t have the negative experience using the app since I was barely using it this past month! Based on the info in this post, Pepper is gonna go under “soon” (whether it will be a few weeks or a few months from now is unknown) and it will be a LOT of hassle to get the bonus Pepper payout. Also, I wouldn’t want to try to dispute say 5 figures worth of charges.

As a counterexample, I won all my Amex chargebacks with CR, and I know others who did. (Along with V/MC. I don’t think I used Discover).

Yeah, I’ve been locked out of my account since the 13th with no response from them. And I honestly have no idea how many points I have locked up in the account at the moment. I also got charged for a transaction that didn’t go through last week. When/if I do get access restored I think I’ll only be using it for personal use moving forward.

What Amex business gold bonus category does this fall into?

US electronic goods retailers or software and cloud system providers.

Is everyone just waiting for “rewards”? Did everyone get the gift cards they purchased?

Yes, except for a few reports of people who had failed purchase and need their credit card refunded. Pepper seems to be fixing those. (Didn’t happen to me)

Jeff- the category is computer supplies.

I have been denied chargebacks when I didn’t receive a “bonus”. I was told I did receive what I bought and paid for. YMMV

Thanks for highlighting the concerns. The company is not really new. Pepper was formerly known as Moocho, which has been around for almost a decade now. I have been using that app ever since they started their POS payment app in several universities across the country.

I agree they are jumping horses in trying to get customers involved. Perhaps they need better minds at management and policy-making.

The initial offer was obviously too good to be true. The current structure seems almost as untenable in the long term (or medium term or maybe near term). I do use the app though because even a 1% return combined with the credit card return is worth it given the minimal effort required. My gift card purchases are small (usually around $50 at a time) and I cash out my points regularly. To date I’ve saved $100 in total and have had no issues.

I agree though that I would not use it as a reselling tool.

Do you “cash out” the points by applying the coins to buy new cards or are you able to directly sell them for cash?

Thank you for the deep dive into Pepper. I think what is missing from both posts is what they do with their money in the short-term. With so many people waiting for their points to accumulate in Pepper, Pepper can put that money in short-term investments that earn a return probably around 5%. That can add up with so many people keeping their points in Pepper. But yes, if they are constantly burning money and don’t take this approach, then it’s not going to end well

my acct got suspended for no reason. No response to support email. No one picks customer support phone number. mY GC are not all accesible in the acct and points.