PayPal has sent out emails to (some?) account holders advising the following:

Beginning on August 10, your account is eligible for Seller Protection to include intangible item transactions.

PayPal already provides Seller Protection for eligible physical goods you ship to your customers. With these changes, we’re expanding Seller Protection to intangible items, such as services and digital goods, so you will be protected on more transactions from “Unauthorized” and “Item Not Received” disputes and chargebacks. If you already have Seller Protection for intangibles, it now includes digital goods. Transactions made before August 10 are not eligible.

For full eligibility details, see the Intangible Goods Additional Requirements in the User Agreement. For this account, we’re waiving the requirement that intangible goods transactions are only eligible if you paid Standard…

The screenshot I was sent cut off after the Standard part, but I’m assuming it goes on to say ‘Standard Transaction Fees’. In the Intangible Goods section of the User Agreement, here’s what it says about additional requirements:

For the sale of intangible goods and services to be eligible for PayPal’s Seller Protection, the sale must meet the basic requirements and the following additional requirements:

- Integration requirements

- Where you have integrated a PayPal checkout product, you must be using the current version of that product if you are accepting payments directly via a website or mobile optimized website; or

- Ensure you are passing session information to PayPal at checkout if you are integrated with PayPal via a third party or if you have a native app integration.

- Other integration requirements may apply depending on your business model. We will let you know those requirements ahead of time, if needed.

- Paid Standard Transaction Fees on the sale.

- Delivered the item and provide Proof of shipment or delivery for Intangible Goods.

- Provide signature confirmation when the full amount of the payment (including shipping and taxes) exceeds the amount listed in the signature confirmation threshold table (based on the currency of the payment). If the full amount of the payment (including shipping and taxes) is in a currency not listed in the table, then signature confirmation is required when the payment exceeds the equivalent of $750 USD at the PayPal exchange rate that applies at the time the transaction is processed.

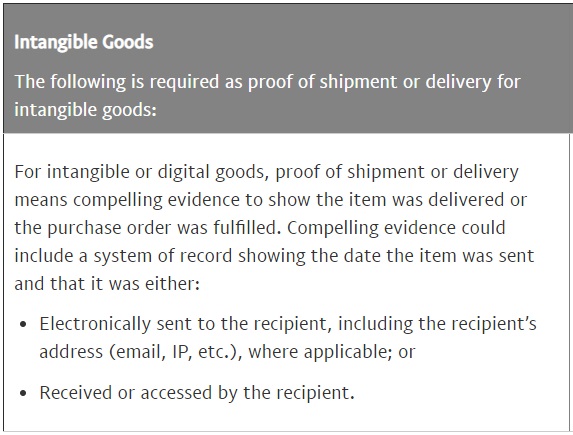

In terms of how to prove that you’ve sent Intangible Goods, here’s what PayPal requires:

This could be great news if you’re a gift card reseller depending on how you conduct your transactions and receive payment. That’s because it reduces the likelihood that you’ll receive chargebacks and disputed transactions and if you do receive any, PayPal will, hopefully, have your back provided you follow the rules listed above.

h/t Eugene