Discounted gift cards are a great way to save money on purchases you need to make anyway. They can also be a good way to make a few additional dollars by reselling cards for more than you bought them for – the quintessential ‘Buy Low, Sell High(er)’!

The great thing is that it’s often possible to stack two or more offers in order to save even more. To give you some ideas – and hopefully some inspiration for other stacking opportunities – here are 6 easy ways to stack gift card purchases to save even more money.

1) Grocery Store + Digital Coupons + Fuel Points + Credit Card Category Bonus

First up, we have grocery stores. Pretty much all grocery stores have a rack containing gift cards for 75+ different retailers, making them a convenient place to pick up gift cards.

Not only are they convenient places to buy the gift cards, but they often offer several opportunities to save money and earn rewards. I’ll use Kroger for this example, but other grocery chains offer similar opportunities.

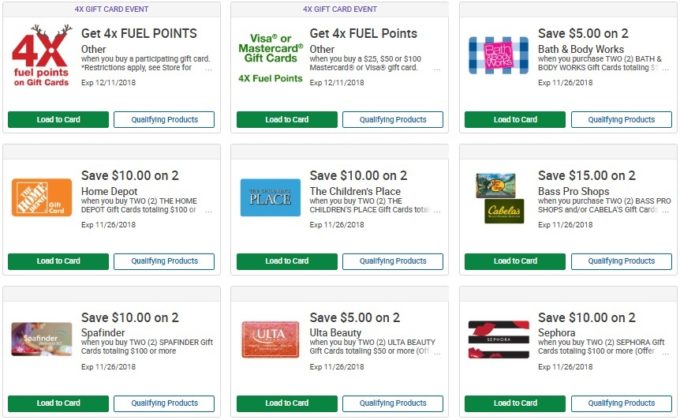

Leading up to Thanksgiving 2018, Kroger released more than 30 digital coupons offering discounts on third party gift cards (i.e. not Kroger’s own gift cards). They also offered a digital coupon for 4x fuel points on third party gift card purchases.

The savings were different for each brand, but they tended to range from 10-20%. Depending on which brands you bought, you could’ve conceivably bought $300 worth of gift cards for $250.

The $250 you’d have paid would’ve earned you 1,000 fuel points. That’s worth $1 off per gallon on up to 35 gallons, thereby saving you up to $35 when filling your car(s). If you were able to take advantage of the full 35 gallon limit, your $300 of gift cards effectively cost you $215. That means you’d have saved $85 which is more than 28%.

But that’s not all! Many credit cards offer bonus points/miles for purchases at grocery stores. For example, the American Express Gold card offers 4 Membership Rewards points per dollar at grocery stores. Your $250 of spend would therefore have also earned 1,000 Membership Rewards which tend to be worth at least $15 when transferring to airline partners. Taking those rewards into account too, you’d have saved/earned about $100 on a $300 purchase.

2) Office Supply Stores + Visa/Mastercard Gift Card Sales + Ink Plus/Ink Cash Credit Card

While grocery stores are a great place to source gift cards, office supply stores (mainly Staples and Office Depot/Office Max) also carry a good selection.

There are a couple of ways to save money and/or earn rewards when purchasing gift cards there. The first is that both Staples and Office Depot frequently offer an instant discount of $10 or $15 when buying $300+ of Visa or Mastercard gift cards. The $200 denomination cards have an activation fee of $6.95, so buying two of those when they’re running one of the $15 instant discount promotions means you can buy $400 of Visa/Mastercard gift cards for a net cost of $398.90. That’s effectively $1.10 of free money for every two cards you buy which is OK, but it gets better.

There are some credit cards that offer bonus points on purchases from office supply stores. Most notably, Chase’s Ink Plus (no longer available for new applications) and Ink Cash cards offer 5x/5% respectively. For every $398.90 you spend at Staples or Office Depot, you earn 1,995 Ultimate Rewards or $19.95 back depending on which of the two cards you own. You therefore earn at least $21 for every two of those cards you buy during one of these promotions.

3) Restaurant Promo Cards + Amex/Chase Offers Or Discounted Happy Gift Cards

Every so often – and particularly leading up to the holiday season – many chain restaurants offer promo cards when buying their gift cards.

This usually comes in the form of buying a $50 gift card and getting a $10 or $15 promo card. The downside of the bonus cards is that they’re usually not regular gift cards but promo cards. Regular gift cards never expire, whereas promo cards have to be used between a certain set of dates (e.g. January 1 to January 31). If you don’t use a promo code by the expiry date, it goes to waste. But if you do use it, you’re getting $60-$65 of gift cards for $50.

You can save even more by taking advantage of Amex Offers, Chase Offers or discounted Happy gift cards. Here’s a quick explanation of how each of those work.

Amex Offers

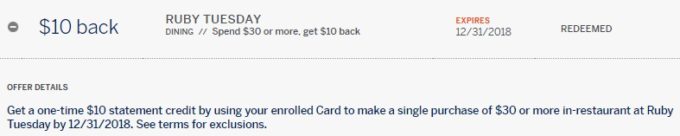

Chase Offers and Amex Offers are similar, but tend to be set up slightly differently. Amex Offers usually give you a specific statement credit amount when spending a certain amount. For example, there was a Ruby Tuesday Amex Offer giving $10 back when spending $30. We used the offer to pay for our meal, but if I’d been better organized we could’ve done much better.

My wife and I each had this offer, so we could have bought a $60 gift card and split the cost between the two cards. As a result, we’d have had a $60 gift card and a $15 promo card for a total value of $75. In return, we’d have paid only $40 after taking into account the two $10 statement credits. That’s a saving of almost 50%.

Chase Offers

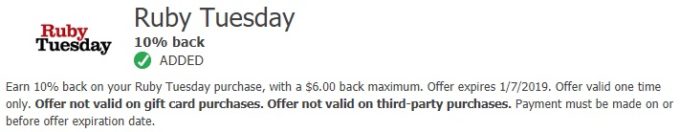

Most Chase Offers are for a certain percentage off your purchase, with an upper limit on the statement credit you’ll receive. For example, they too had an offer for Ruby Tuesday. This was for 10% back with a limit of $6 cashback, so you’d earn cashback on up to $60 of spend. That’s not as generous as the Amex Offer, but it’s still better than nothing.

Happy Gift Cards

Happy gift cards work differently to Amex and Chase Offers but also offer an opportunity for further savings. These particular gift cards are ones that can be used at a specific set of retailers. For example, Happy Bites cards can be used at Noodles & Company, Jamba Juice, Peet’s Coffee, Burger King and Panera Bread.

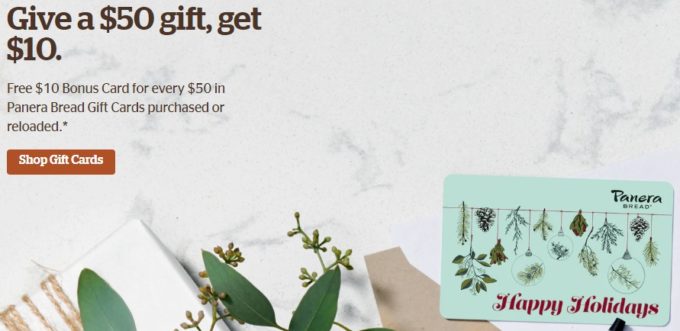

Happy gift cards can often be bought at a discount, such as $150 of cards for $130. If you bought a $150 Happy Bites gift card, you could use it to buy $150 of Panera gift cards when they’re running one of their promo card offers. With a $10 bonus card for every $50 of Panera gift cards, your initial outlay would be $130 and you’d end up with $150 in regular gift cards and $30 of promo cards. If you could make use of all those promo cards, that’s a saving of almost 28%.

Even better, those discounted gift cards were being sold by Office Depot. By paying with a Chase Ink Plus or Ink Cash card, you’d earn 650 Ultimate Rewards or $6.50 too.

4) Savings Codes + Reward Schemes

This stacking opportunity is largely confined to Best Buy, but it can be good if you’re planning purchases there. Several times a year, Best Buy sells $150 eGift cards that come with a $15 savings code and there’s usually a limit of three per person. These savings codes are similar to restaurant promo cards in that they have to be used by a certain date or they’ll expire. The savings cards therefore can’t be resold, but it effectively works out as a 9% discount for personal purchases.

Best Buy also runs its own rewards scheme that offers 1-2.5% back depending on your status level (your status is based on how much you spend with them each year). Unusually compared to other retailers’ loyalty schemes, Best Buy awards those points when you buy gift cards rather than when you use them. That means that if you bought $450 of these eGift cards, you’d end up with $450 in gift cards, $45 in savings codes and $4.50 to $11.25 in Best Buy Rewards. That’s a total of $499.50 to $506.25 in value for $450 – savings of ~10-11% if you value Best Buy Rewards at their stated value.

While not as good as some discounted gift card opportunities, it’s still a great discount on Best Buy purchases.

5) Coupon Codes + Cashback Portals + Discounted Happy Gift Cards

Similar to the Best Buy opportunity above, stacking cashback portals and coupon codes is a rare opportunity. That’s because coupon codes can normally only be used for product purchases rather than for gift cards.

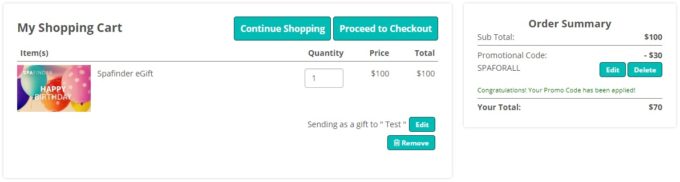

One exception (although there might be others) is Spafinder. At the time of writing this guide, they’re offering 30% off gift card purchases of $100+ when using code SPAFORALL.

30% off is good, but you can do better. First off, Spafinder is available on some cashback portals, with TopCashback offering up to 10% at times. Secondly, Spafinder is one of the retailers where you can use some Happy gift cards like Happy Lady and Happy Bride.

Depending on how good a discount you can get on Happy gift cards, you could stack the coupon code, portal cashback and discounted Happy gift cards to save 37-45%.

6) Wholesale Clubs + Credit Cards With Quarterly Categories

Wholesale clubs like Sam’s Club, Costco and BJ’s sell a limited number of gift card brands at a discount. The discounts they offer sometimes increase, such as when Costco sells $100 of iTunes gift cards for $84.49 rather than their usual price of $94.49.

At certain times of the year, you can stack these discounted gift cards with bonus credit card rewards. Wholesale clubs are often included as a 5% category for one quarter each year with the Chase Freedom and Discover credit cards. The 5% is only earned on the first $1,500, but that’s up to $75 back on already discounted gift cards.

Now that you have some ideas for how to stack gift card purchases, check out our list of 25+ ways to save money on gift cards.